9 Smart Ways to Boost Your Financial Literacy Today

Financial literacy is the key to unlocking a stable and prosperous future. Understanding how to manage your money, invest wisely, and plan for the future can make all the difference in achieving your financial goals. Whether you’re just starting out on your financial journey or looking to refine your skills, these nine tips will help you boost your financial literacy and make informed decisions. Let’s dive into these practical strategies that will empower you to take control of your financial destiny.

1. Understanding the Basics

Before diving into complex financial concepts, it’s crucial to understand the basics. Financial literacy starts with knowing how to read financial statements, understanding cash flow, and recognizing the importance of setting financial goals. Familiarize yourself with key terms like assets, liabilities, income, and expenses. Once you have a firm grasp of these concepts, you’ll find it much easier to navigate more advanced financial topics.

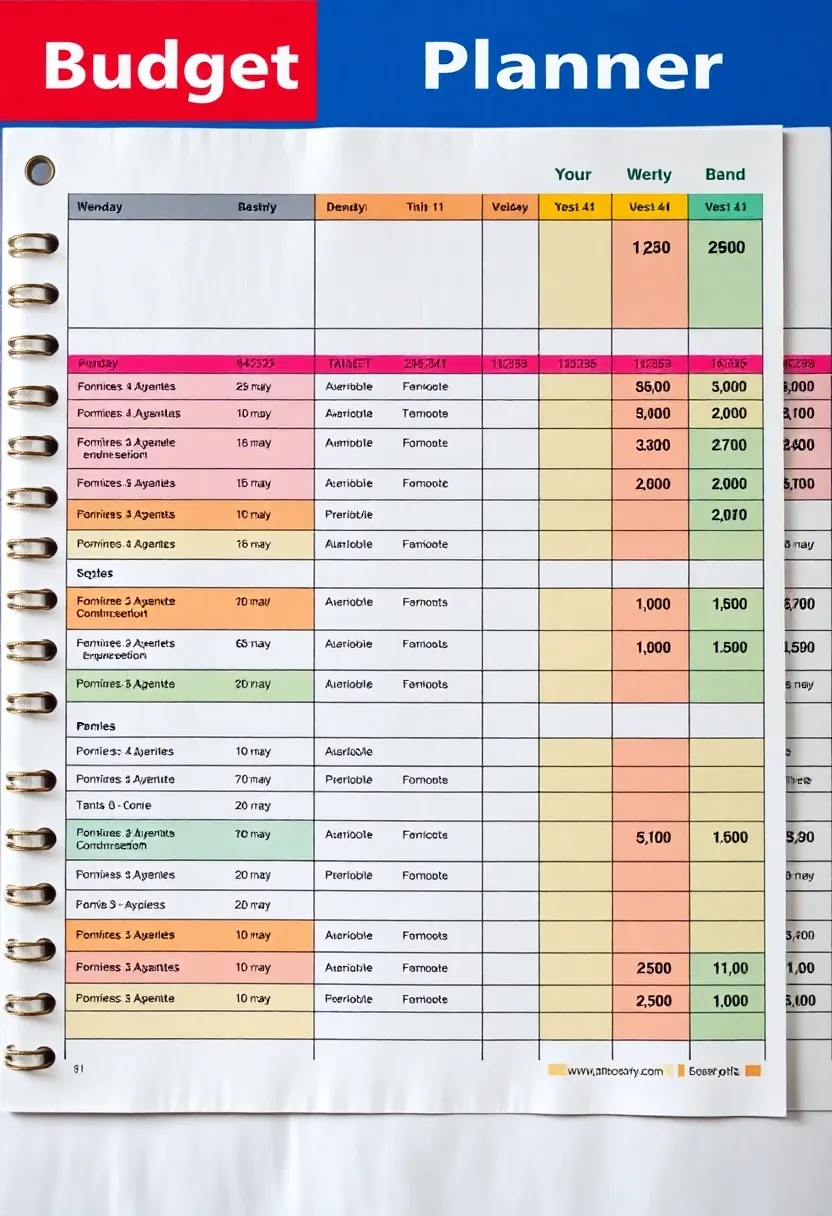

2. Creating a Budget

Budgeting is the cornerstone of financial literacy. It helps you keep track of your income and expenses, ensuring you live within your means. Start by listing all your sources of income, then categorize and track your expenses. Aim to allocate funds for savings, investments, and leisure while ensuring your essential needs are met. Regularly review your budget to adapt to any changes in your financial situation.

3. Saving Strategically

Saving money is more than just putting cash aside. Strategic saving involves setting clear goals, such as an emergency fund or a vacation budget, and choosing the right saving vehicles. Consider high-yield savings accounts or certificates of deposit (CDs) for better returns. Remember, the earlier you start saving, the more you benefit from compound interest, which can significantly boost your wealth over time.

4. Investing Wisely

Investing is a powerful tool for growing your wealth, but it requires knowledge and discipline. Start by understanding different asset classes such as stocks, bonds, and real estate. Diversify your portfolio to minimize risk and consider your risk tolerance and investment horizon. Remember, investing is a long-term game, and patience often pays off with substantial returns.

5. Understanding Credit

Credit is a double-edged sword; it can help you achieve financial goals but can also lead to debt if not managed properly. Learn how to read your credit report, understand your credit score, and know the factors that influence it. Use credit responsibly by paying your bills on time, maintaining low balances on credit cards, and only borrowing what you can afford to repay.

6. Managing Debt

Debt management is an essential skill in financial literacy. Prioritize paying off high-interest debts first and consider consolidation options if available. Develop a repayment plan that fits your budget and stick to it. Avoid taking on new debt unless necessary, and remind yourself that eliminating debt can free up resources for savings and investments.

7. Planning for Retirement

It’s never too early to start planning for retirement. Understand the different retirement accounts available, such as 401(k)s and IRAs, and take advantage of any employer matches. Consider the kind of lifestyle you want in retirement and calculate how much you need to save to achieve it. Regularly review and adjust your retirement plan to ensure it aligns with your long-term goals.

8. Staying Informed

The financial world is constantly evolving, and staying informed is crucial. Follow financial news, subscribe to reputable finance blogs, and consider taking online courses to enhance your knowledge. Engaging with a community or joining forums can also provide valuable insights and keep you motivated on your financial journey.

9. Seeking Professional Advice

Sometimes, the best way to enhance your financial literacy is to seek professional advice. Financial advisors can provide personalized guidance tailored to your needs and goals. They can help you create a comprehensive financial plan and offer insights you might not have considered. Don’t hesitate to reach out for help, especially when making significant financial decisions.

Enhancing your financial literacy is a lifelong journey that pays off in numerous ways. By understanding financial basics, budgeting, saving, and investing wisely, you set the stage for a secure financial future. Remember, knowledge is power, and with the right tools and strategies, you can confidently navigate the complex world of finance. Stay informed, seek advice when needed, and continually strive to improve your financial literacy.