9 Steps to Financial Freedom You Can Start Today

Achieving financial freedom might sound like a distant dream, but it’s more attainable than you think. By breaking down your goals into actionable steps, you can pave your way to a life where money is a tool, not a stressor. Whether you’re just starting your financial journey or looking to refine your strategy, these nine steps will guide you towards the financial freedom you’ve always desired.

1. Understand Your Current Financial Situation

Before you can plot a course towards financial freedom, you need to understand where you currently stand. Gather all your financial documents, take note of your income, expenses, assets, and liabilities. This will give you a clear picture of your financial health and help you identify areas that need improvement. Understanding your current situation is like getting a financial health check-up; it’s the first step towards making informed decisions.

2. Set Clear Financial Goals

Setting clear, specific financial goals gives you something to aim for. Whether it’s saving for a vacation, buying a home, or retiring early, having a target in mind will motivate you to stay on track. Break down your goals into short-term, medium-term, and long-term objectives. This way, you’ll have a roadmap to follow and can celebrate small victories along the way.

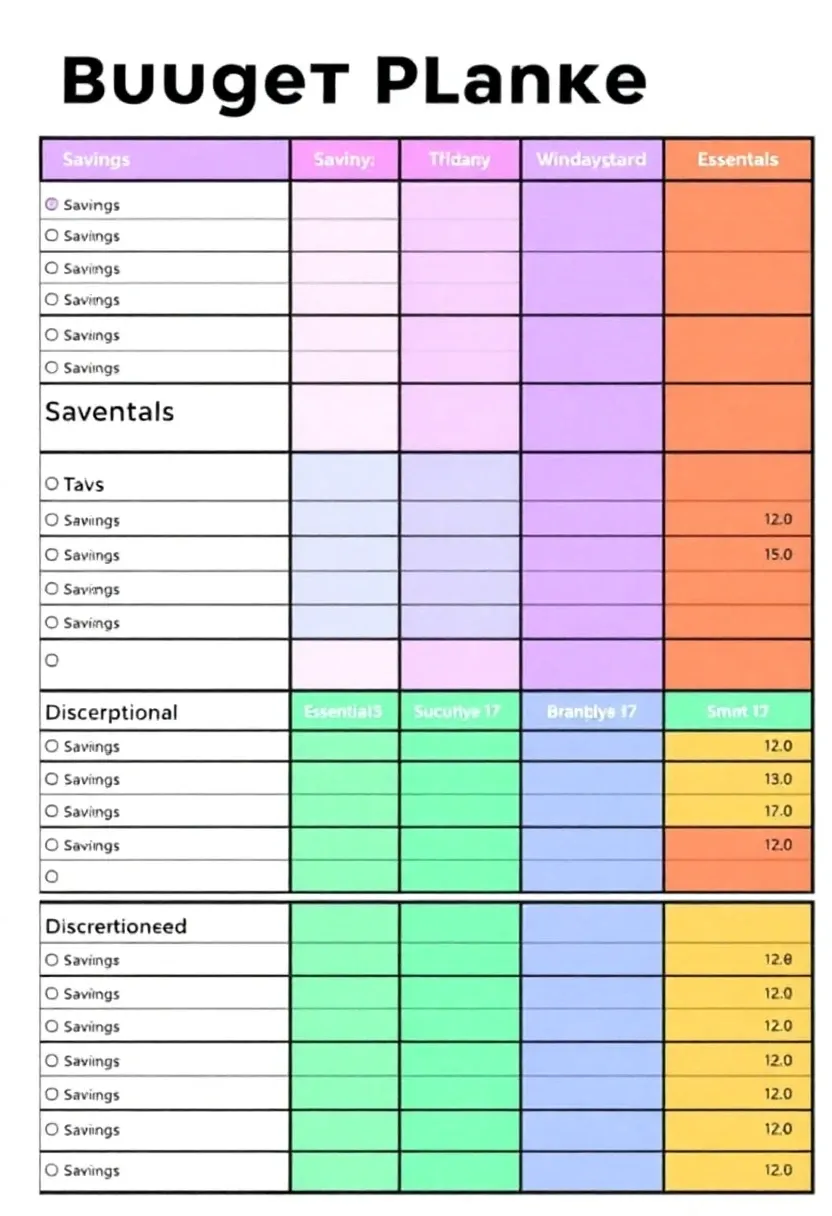

3. Create and Stick to a Budget

A budget is your financial blueprint. It helps you control your spending and ensure that you’re living within your means. Start by tracking your monthly income and expenses, then categorize them into essentials, savings, and discretionary spending. Stick to your budget by reviewing it regularly and making adjustments as needed. Remember, a budget isn’t restrictive; it’s a tool for empowering your financial choices.

4. Build an Emergency Fund

Life is unpredictable, and having an emergency fund can be your financial safety net. Aim to save at least three to six months’ worth of living expenses. This fund should be easily accessible and reserved solely for emergencies like medical expenses, car repairs, or unexpected job loss. With an emergency fund, you’ll have peace of mind knowing you’re prepared for life’s curveballs.

5. Eliminate Debt

Debt can be a significant barrier to financial freedom. Prioritize paying off high-interest debt first, like credit card balances. Use strategies like the snowball or avalanche method to systematically pay down debts. As you eliminate debt, you’ll free up more of your income to save and invest, bringing you one step closer to financial independence.

6. Invest Wisely

Investing is a powerful tool for growing your wealth over time. Start by educating yourself about different investment options, like stocks, bonds, and mutual funds. Consider your risk tolerance and time horizon when choosing investments. Remember, investing is a long-term game, and patience is key. With the right strategy, your money can work for you and accelerate your path to financial freedom.

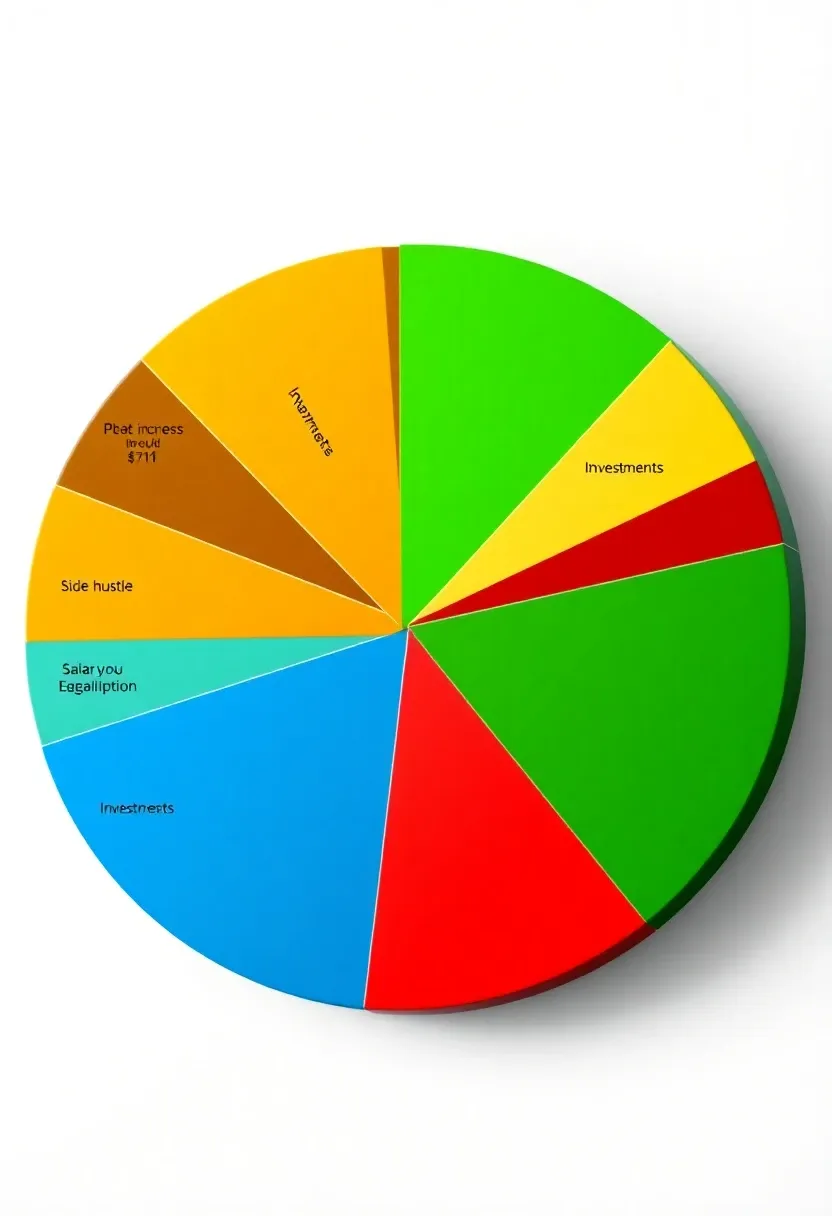

7. Diversify Your Income Streams

Relying on a single source of income can be risky. Look for ways to diversify your income streams, such as starting a side hustle, investing in rental properties, or creating passive income through dividends or royalties. Multiple income streams provide stability and can significantly boost your financial flexibility, helping you reach your goals faster.

8. Continuously Educate Yourself

Financial literacy is a lifelong journey. Stay informed about personal finance trends, investment opportunities, and economic changes. Read books, attend workshops, and follow reputable finance blogs and podcasts. The more you know, the better equipped you’ll be to make smart financial decisions that align with your goals.

9. Monitor and Adjust Your Plan

Financial freedom isn’t a set-it-and-forget-it goal. Regularly review your financial plan to ensure you’re on track to meet your goals. Life circumstances change, and your financial strategy should adapt accordingly. By staying proactive and making necessary adjustments, you’ll keep moving forward on your path to financial independence.

Financial freedom is a journey, not a destination. By taking these steps, you’ll build a solid foundation for your financial future. Remember, the key to success is consistency and adaptability. Celebrate your progress, learn from setbacks, and keep pushing towards your goals. With determination and the right strategy, financial freedom is within your reach.