9 Genius Financial Life Hacks You Need to Try Right Now

Navigating personal finance can often feel like walking through a maze. But what if you had a map to guide you? In this article, we’re revealing nine genius financial life hacks that can help you save money, manage debt, and grow your wealth. Whether you’re a budgeting beginner or a seasoned saver, these tips will empower you to take control of your financial future with ease. So, let’s dive in and transform your money management skills today!

1. Automate Your Savings

One of the simplest ways to save money is by automating your savings. Set up automatic transfers from your checking account to your savings account each payday. This ‘set it and forget it’ approach ensures you’re consistently saving without having to think about it. Even small amounts add up over time, and you’ll be surprised at how quickly your savings grow. Consider using apps that round up your purchases and save the difference, making it even easier to build your nest egg.

2. Use Cashback Apps

Cashback apps are a fantastic way to earn money on purchases you’re already making. Apps like Rakuten, Ibotta, and Honey offer cashback on a wide range of retailers. Simply shop through their links, and you’ll receive a percentage back. It’s like getting paid to shop! The key is to make purchases you would have made anyway, so you truly benefit from the cashback without overspending.

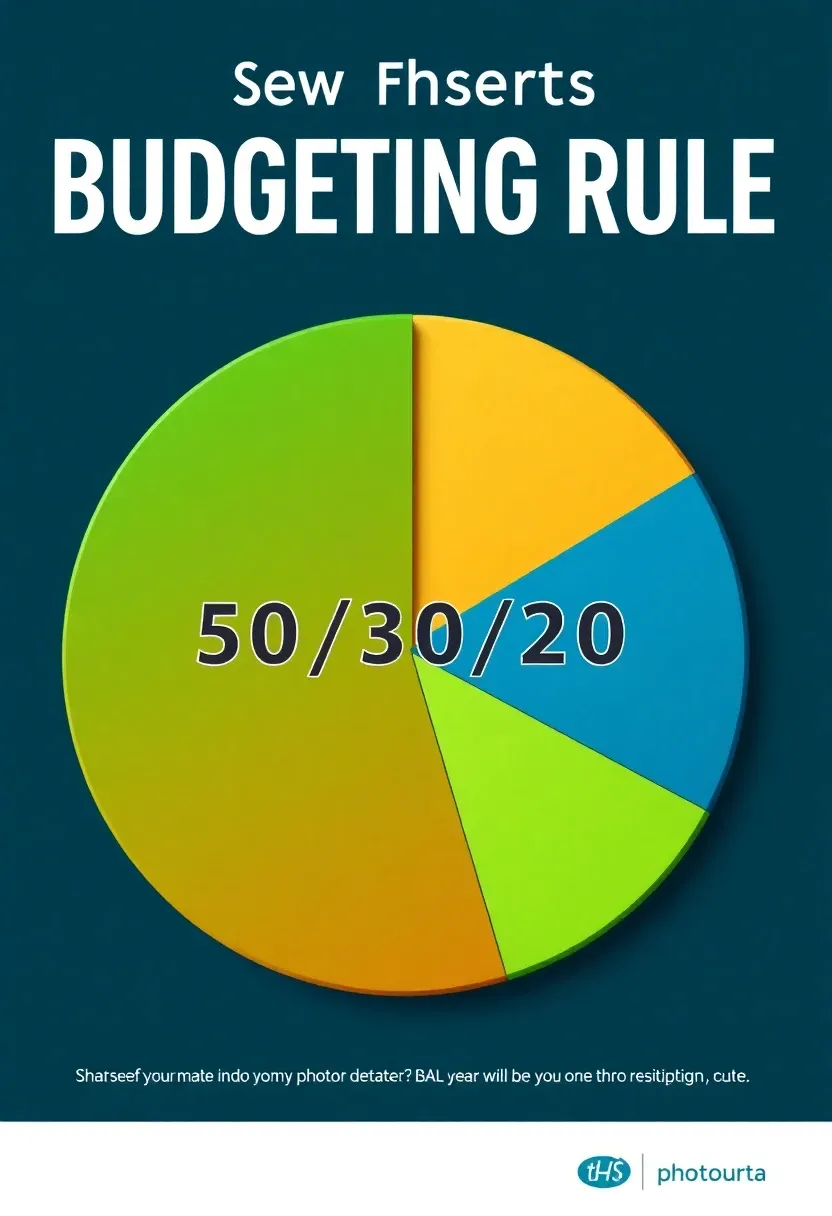

3. Embrace the 50/30/20 Rule

The 50/30/20 rule is a straightforward budgeting method that helps you allocate your income efficiently. Spend 50% of your income on needs, 30% on wants, and 20% on savings or debt repayment. This approach simplifies budgeting by providing clear spending limits, helping you avoid overspending while ensuring you’re saving enough for the future. Adjust the percentages to fit your personal financial goals and lifestyle.

4. Refinance Your Loans

Refinancing loans, such as student loans or a mortgage, can lead to significant savings. By securing a lower interest rate, you reduce the amount you’ll pay over the life of the loan. It’s important to shop around and compare rates from different lenders. Keep an eye out for refinancing opportunities, especially when interest rates drop. Just be sure to weigh any fees associated with refinancing against the potential savings.

5. Cut Unnecessary Subscriptions

It’s easy to lose track of subscriptions, especially those you signed up for on a whim. Take the time to review your monthly expenses and identify subscriptions you no longer use or need. Canceling these can free up money for savings or more important expenses. Apps like Truebill can help you track and manage your subscriptions, ensuring you’re only paying for what you truly value.

6. Invest in Index Funds

Index funds are a smart investment choice for those looking to grow their wealth over time. These funds are designed to track the performance of a specific market index, such as the S&P 500. They offer diversification and typically have lower fees compared to actively managed funds. Investing in index funds is a long-term strategy that can help you build wealth steadily, without the need to constantly monitor the stock market.

7. Create a Sinking Fund

A sinking fund is a strategic way to save for upcoming expenses, such as holidays, car maintenance, or home repairs. By setting aside a small amount of money each month, you can prepare for these costs without dipping into your emergency savings. Determine the total amount needed and the time frame, then divide it into manageable monthly savings. This proactive approach relieves financial stress and keeps your budget on track.

8. Use a Zero-Based Budget

Zero-based budgeting involves assigning every dollar a specific purpose, ensuring that your income minus expenses equals zero. This method forces you to prioritize spending, eliminate waste, and maximize savings. It requires a detailed review of all income and expenses, but the payoff is a more disciplined and intentional financial plan. Apps like YNAB (You Need A Budget) can simplify the process, helping you allocate funds effectively.

9. Leverage a Side Hustle

A side hustle can be a powerful tool for boosting your income and achieving financial goals faster. Whether it’s freelancing, selling crafts, or leveraging skills like tutoring, the extra cash can be used to pay off debt, build savings, or fund a passion project. Choose a side hustle that aligns with your interests and schedule, ensuring it complements rather than exhausts your lifestyle.

Implementing these nine financial life hacks can transform the way you manage money and set you on a path to financial freedom. By automating savings, leveraging technology, and adopting smart budgeting techniques, you’ll be better equipped to handle whatever financial challenges come your way. Remember, small changes can lead to big results over time. Start with one or two hacks and gradually incorporate more into your routine. Your future self will thank you!